What You Need To Know About Pre-Approval

What You Need To Know About Pre-Approval

Some Highlights

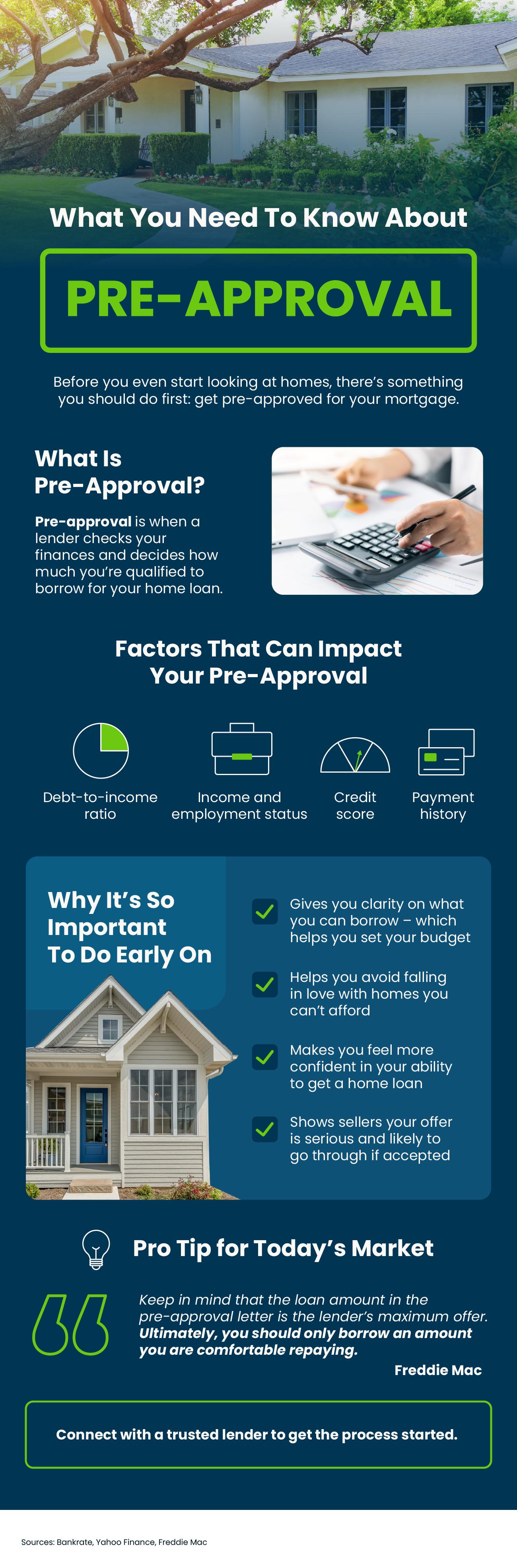

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

Should I Attend Open Houses? What Buyers (and the Curious) Need to Know

What Is a Probate Sale? A Simple Guide for Buyers and Sellers

Single-Family vs. Condo/Townhome Living: Which Is Right for You?

Buying vs. Renting: Pros, Cons, and What’s Right for You

What’s Your Home Really Worth? How an Equity Review Can Unlock Big Opportunities

What Home Inspectors Really Look For (And How It Affects Your Deal)

Outdoor Living Upgrades: How to Create Your Dream Backyard

The Hidden Costs of Buying a Home (And How to Plan for Them)

Will the Real Estate Market Crash? Here's What You Need to Know in 2025

Real Estate Taxes vs. Property Taxes: What's the Difference?